Frequently Asked Questions

How to export your goods from Singapore?

Overview guideline on exporting goods from Singapore.

Exports In General

Goods exported from Singapore are regulated under the Customs Act, the Regulation of Imports and Exports Act, the Strategic Goods (Control) Act, and other legislation by the relevant Competent Authorities (CAs).

To export goods from Singapore, you are required to declare the goods to Singapore Customs. Goods and Services Tax (GST) and duty are not levied on goods exported from Singapore.

How to Export Your Goods?

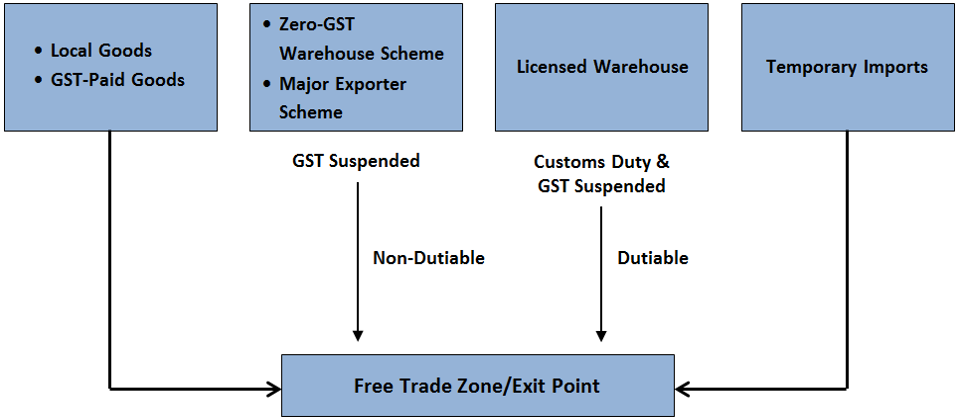

To account for the export of your goods (for example, from customs territory, zero-GST warehouse, licensed warehouse or goods imported under the Major Exporter Scheme to a free trade zone (FTZ) or exit checkpoint), please follow the steps below to obtain the relevant export permits and authorisation (if the goods are subject to control) from the relevant CAs.

Step 1 : Register for UEN and Activate Customs Account

Entity can register with the Accounting and Corporate Regulatory Authority (ACRA) or the relevant Unique Entity Number (UEN) issuance agency to obtain a UEN and Activate its Customs Account.

If entity intends to:

- Engage in import or export activities in Singapore, or

- Apply for import, export and transhipment permits or certificates

Step 2: Check if your goods are controlled

Do check if the goods you intend to export are controlled goods subject to restrictions by Competent Authorities (CAs) in Singapore.

You may search: https://www.tradenet.gov.sg/tradenet/portlets/search/searchHSCA/searchInitHSCA.do using the description of the goods, Harmonized System (HS) code or CA product code. If the item is subject to control, you may check directly with the respective CAs on their licensing requirements.

If you require advice on the full 8-digit HS code of the product, you may apply for an official classification ruling at a fee of S$75 per product. Please note our classification rulings are only applicable for use within Singapore.

Step 3: Apply for Customs Export Permit

You may:

- Appoint a declaring agent to apply for Customs export permits on your behalf; or

- Apply for Customs permits on your own or on behalf of your clients. To do so, you will need to register as a declaring agent and apply for a TradeNet user ID

All permit applications must be submitted electronically via TradeNet, which is accessible through:

- TradeNet front-end solution from any approved solution provider, or

- Government Front-End Application.

Each permit application typically costs S$2.88. If you are engaging a declaring agent, you may wish to check with your appointed agent on the charges involved in obtaining a permit.

Step 4: Prepare Documents for Cargo Clearance

Approved permits are issued with a validity period. You should ensure the validity of the permit presented for goods clearance.

a) Documents Required for Containerised Cargo

For containerised cargo, please produce the cargo with the approved Customs export permit and supporting documents such as invoice, packing list, Bill of Lading/Airway Bill, to the checkpoint officers if it is specified in the permit conditions or if the cargo is dutiable or controlled. Please have the permit number at the point of cargo lodgement for verification purposes.

An example of conditions in the permit indicating this requirement:

- A2: The goods and this permit with invoices, BL/AWB, etc must be produced for Customs clearance / endorsement at a Free Trade Zone ‘Out’ Gate unless it is directed to the ‘Green Lane’ at the time of clearance.

- H1: The goods and this permit with invoices, BL/AWB, etc must be produced for Customs clearance / endorsement at Woodlands Checkpoint / Tuas Checkpoint.

- A3: The goods must be produced with this permit, invoices, BL/AWB, etc for Customs endorsement at an Airport Customs checkpoint or designated Customs office or station as required.

A Customs export permit is required to cover for:

- Export of dutiable goods from licensed warehouses

- Export of goods from bonded warehouses

- Export of goods under the Temporary Export Scheme

- Re-export of goods previously imported under the Temporary Import Scheme

b) Documents Required for Conventional Cargo

For conventional cargo, please produce the approved Customs export permit and supporting documents such as invoice, packing list, Bill of Lading/Airway Bill, to the checkpoint officers if it is specified in the permit conditions or if the items are dutiable or controlled. Please also have the permit number at the point of cargo lodgement for verification purposes.

An example of conditions in the permit indicating this requirement:

- A2: The goods and this permit with invoices, BL/AWB, etc must be produced for Customs clearance / endorsement at a Free Trade Zone ‘Out’ Gate unless it is directed to the ‘Green Lane’ at the time of clearance.

- H1: The goods and this permit with invoices, BL/AWB, etc. must be produced for Customs clearance / endorsement at Woodlands Checkpoint / Tuas Checkpoint.

- A3: The goods must be produced with this permit, invoices, BL/AWB, etc for Customs endorsement at an Airport Customs checkpoint or designated Customs office or station as required.

A Customs export permit is required for:

- Export of dutiable goods from licensed warehouses

- Export of goods from bonded warehouses

- Export of goods under the Temporary Export Scheme

- Re-export of goods previously imported under the Temporary Import Scheme

Please note that partial clearance is not allowed for goods departing Singapore via Woodlands and Tuas checkpoints. You should submit one permit application for each container or vehicle of cargo.

Step 5: Retain your Trade Documents

Generally, you are required to retain the relevant supporting documents relating to the purchase, import, sale or export of the goods for a period of 5 years from the date of approval of the Customs permit.

These documents can be stored as physical hardcopies or as images. You are required to produce these supporting documents to Singapore Customs upon request.